Ongoing Recruitment of Accredited Funds

(18.08.2020 / 12.03.2023) Accredited Fund Recruitment Notice.

NCBR Investment Fund ASI S.A. with its registered office in Warsaw, entered into the Register of Entrepreneurs of the National Court Register under KRS [National Court Register] number: 0000793596, ul. [street] Nowogrodzka 47A, Warsaw, correspondence address: ul. [street] Wspólna 70, Warsaw („NIF”) informs about: the commencement of continuous and open recruitment of Accredited Funds (co-investment partners) with which NIF will jointly co-invest in Portfolio Companies, while maintaining pari passu conditions.

Information on the recruitment of Accredited Funds

NIF implements the strategy of a private equity fund, of the Venture Capital type. NIF is a co-investment fund, i.e. investing solely together with one or more Accredited Funds on equal terms (pari passu). The Accredited Fund of NIF may be a VC or PE fund or a medium or large entrepreneur within the meaning of Annex I to Commission Regulation (EU) No. 651/2014 of 17 June 2014 declaring certain types of aid compatible with the internal market pursuant to Art. 107 and 108 of the Treaty, conducting investment activity on the venture capital market (regardless of the legal form in which it is conducted, with the exception of a civil partnership or sole proprietorship), established and operating in accordance with the law applicable to the place of its seat. The selection of the Accredited Funds will be made public on the NIF website, respecting the business secrets of the selected Accredited Funds. NIF reserves the right to suspend or finish the recruitment, which will be announced on its website.

The amount of funds for investments

NIF intends to allocate a total of PLN 700 million in the years 2020-2026 to co-investments with Accredited Funds (i.e. approximately PLN 100 million per year). The assumed involvement in the Portfolio Company will be from approx. PLN 3 million to approx. PLN 64 million in total, which will be made by each party of the co-investment, as part of one or more financing rounds, with at least 50% of the investment coming from one or many co-investors, and at the same time at least 30% of the total investment in a given round will come from private investors. The main investment objective of NIF is to increase the value of assets as a result of an increase in the value of the investments held.

Method of submitting applications by potential Accredited Funds

Applications may be submitted from 18 August 2020 in a continuous recruitment. The application form with the appendices should be prepared in Polish or in English. Documents prepared in English may be sent together with a translation into Polish. In case of discrepancies, the Polish language version is binding. The application form with the appendices should be submitted on paper and in electronic form (pen drive) and delivered to the NIF’s correspondence address in person or by post.

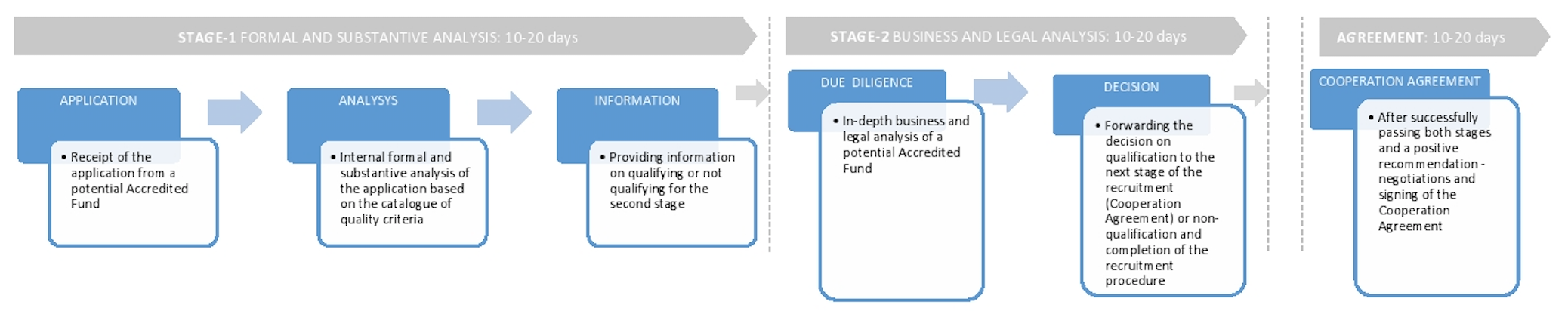

Accredited Fund Selection Process

Stage 1: Formal and substantive (10-20 days)

- Application

Receipt of the application a potential Accredited Fund - Analysys

Internal formal and substantive analysis of the application based on the catalogue of quality criteria - Information

Providing information on qualifying or not qualifying for the second stage

Stage 2: Business and legal analysis (10-20 days)

- Due diligence

In-depth business and legal analysis of a potential Accredited Fund - Decision

Forwarding the decision on qualification to the next stage of the recuriment (Cooperation Agreement) or non-qualification and completion of the recruitm ent procedure

Stage 3: Agreement (10-20 days)

- Cooperation agreement

After sucessfully passing both stages and a positive recommendation – negotiations and signing of the Cooperation Agreement